China launches major audit of country’s financial system to root out corruption

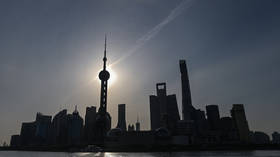

Beijing has announced a major inspection of the country’s financial regulators, insurers, bad-debt managers and its biggest state-controlled banks, the Central Commission for Discipline Inspection said in a statement.

The two-month scrutiny of the China Banking and Insurance Regulatory Commission (CBIRC) is reportedly expected to root out corruption in the nation’s $54-trillion financial system. The commission also said that complaint reports from whistleblowers would be accepted until mid-December.

The move reflects Beijing’s focus on financial regulation, according to CBIRC Chairman Guo Shuqing, who said that cooperation with inspectors would be their top priority.

Also on rt.com China to plunge into power crunch as looming Evergrande default sends shockwaves through financial sector – mediaThe close audit comes as part of a broader program of inspection that was launched in 2017 and zeroed in on 25 financial organizations. While previous checks had targeted other central and local government agencies along with state-owned corporations, the latest one will reportedly be focused on the People’s Bank of China, the China Securities Regulatory Commission, the Shanghai and Shenzhen stock exchanges, the biggest state-owned banks, as well as bad-debt managers including China Huarong Asset Management.

The measure is a reflection of the government’s tough policy towards corruption among corporate executives. Over 1.5 million government officials have been brought to trial during the long-running crackdown.

Also on rt.com China’s refinery crackdown leaves oil tankers with nowhere to goEarlier this year, a Chinese court sentenced Lai Xiaomin, the former chairman of state-owned financial giant Huarong, to death after finding him guilty of bribery. The former chairman of China Development Bank Hu Huaibang was sentenced to life behind bars for taking $13.2 million in bribes.

The People’s Bank of China, the State Administration of Foreign Exchange, sovereign wealth fund China Investment, and Huarong reportedly issued similar statements on Tuesday, announcing the launch of inspections. The inspection team leaders stressed the need to prevent “systematic financial risks,” while the top officials of the audited agencies vowed full cooperation.

For more stories on economy & finance visit RT's business section