Meet bitcoin, 2013's biggest winner

Adding 6200 percent, bitcoin was the biggest economic winner of 2013. However, a lot remains unclear about how the virtual currency works and is created. RT spoke to Robin Tiegland from the Stockholm School of Economics to shed a little light.

RT: Can you explain in layman’s terms how Bitcoin is ‘mined’?

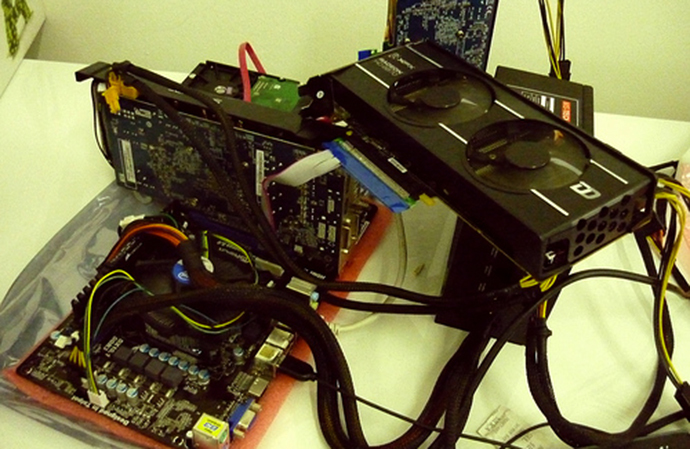

-Bitcoin mining is the process of using computer power to process Bitcoin transactions, secure the Bitcoin network, and ensure that the decentralized Bitcoin system is synchronized. When a person mines Bitcoins, he/she uses specialized Bitcoin software and hardware to perform certain tasks to confirm Bitcoin transactions occurring in the network. In return for conducting these tasks that make the Bitcoin network a secure payment network, individuals or pools of individuals are paid a fee, at the moment a block of 25 Bitcoins.

RT: Can an ordinary person without any technical knowledge create bitcoin?

-You can, but it takes a long time now because the algorithms are getting more and more difficult and more and more processing power is needed. My doctoral student is mining bitcoins. She is a clever person, but she doesn’t have a high degree of technical skill or the experience of a programmer or anything like that. So it is possible. And there is enough help online for people to figure out how to do this. I think there is a very good support group. So while you don’t need any special technical knowledge, you should be very skilled in the sense of knowing how to access knowledge on the internet as well as interacting with online communities. People should be able to do this.

The complexity of the algorithm depends on the number of bitcoins. It is actually predetermined, and the amount of bitcoins entering the system will never go higher than 21 million, which is to be reached in 2140. So the progression will never go faster and the amount of time to crack the coin will always stay the same.

RT: Who has set this limit of 21 million? Why did they say that the number of bitcoins is limited?

-No one really knows who or why since no one has ever really spoken to Satoshi Nakamoto, the pseudonym of a person or a group of people behind bitcoin. When the original code was written, this is what was written in the protocol: that 21 million will be the limit of the number of Bitcoins to be released into the system, and it will be reached by 2140. I was speaking the other day to some gurus of the global bitcoin community, and they said it can never go faster because it will always reset; it takes 8-10 minutes for a block chain to be mined. Similar to gold, it has a limited amount; however, different from gold, you can divide bitcoin to 8 or 10 decimal points. But one day the bitcoin community potentially may say, let’s increase the number of zeros that we actually can divide the currency into.

RT: And what benefits do those who create bitcoins get? Why should I want to create bitcoin?

-There are a number of reasons. You might want to mine Bitcoin because of the challenge in doing so or because of the reputation effect - it can be fun and cool, cracking code and mining Bitcoins. Or you might want to be part of a larger community either in your region or country or perhaps part of the Bitcoin community that spans the globe. Then there is also the possibility of making money through mining bitcoins, but you’ll need about six months to recoup the money you need to invest in the specific hardware. Finally, you might want to buy things in bitcoins or you could view bitcoins merely as an investment. But it is actually easier to exchange your dollars or euros or any other currency into bitcoins through one of the bitcoin exhanges.

RT: So the two processes are separate: people are interested in creating crypto-currency and buying it?

-Yes, you could say that. There are a number of people who have no technical competence nor interested in mining bitcoins but who are buying bitcoins merely as an investment.

RT: Why do you think Bitcoins have become so popular? Can a crypto-currency become a viable alternative to conventional currency?

-Yes, I think we are on our way to seeing this. Bitcoin is actually only one of the 59 different crypto-currencies at the moment, which have a market capitalization of around $8.5 billion. So I think one of the reasons Bitcoin has become so popular is the interest and willingness of people to disconnect money from the government. In the case of bitcoin, money is something not controlled by any central authority or bank. You also have people who are very much upset with the financial system, the banking system, because it takes such high fees and can be seen as very inefficient now with the internet. While with bitcoin you can send it to anyone, anywhere in the world, even micropayments instantly. So I can send a dollar to a programmer in Pakistan and it will only take a couple of minutes, while a bank transfer will take a couple of days and cost me $30-50 to send the money, more than the amount I would like to send. There are also people who see bitcoin as a speculative investment, agamble, looking for a profit. That might be a bubble, I think it’s quite a bubble now at the rate of $1,200 per bitcoin, but it is could also be an investment opportunity if one buys at the right time.

RT: Can it be a real alternative to conventional money?

-Yes, I think it already is because people are trading and making transactions every day all over the globe – there are at least 60,000 Bitcoin transactions a day. I would say some communities are using it as an alternative form of payment. I know entrepreneurs who use it every day, they prefer to trade, buy and sell services using Bitcoins. So when people start using and trading with it, it’s already an alternative to everyday money. I think it’s the beginning of many different crypto-currencies we will see.

RT: What will happen to Bitcoin when it becomes regulated?

-I think it’s very difficult for bitcoin to become completely regulated because it is so spread out over the community across the world. You will have to get many of the governments in the world to agree on how to regulate it. However, the government of Thailand has declared bitcoin illegal, for example, yet people are still conducting transactions with it there.

On the one side, bitcoin is good because you can see all the transactions ever made with bitcoin online. And if the government tries to close down bitcoin or regulate it too hard, another currency will take its place, another form, probably less transparent. So you might drive things underground. So, I think, that governments will instead see what they can do in terms of tracking, in terms of legitimizing perhaps, some forms of softening regulations but not regulating it from the perspective of stopping it. Regulating from the perspective of making taxes on it, paying capital gains, but not being regulated by other financial instruments.