EU debt reaches all-time high of $11.4 trillion

Government debt in the euro zone reached an all-time high of 92.2 percent of GDP in the first financial quarter, despite large-scale efforts by leaders to dig their countries out of recession through austerity measures.

Eurozone debt, in total, has swelled to $11.4 trillion (8.75

trillion euro), jumping from 8.6 trillion euro from the previous

quarter and 8.34 trillion euro in 2012.

Official Eurostat data shows the debt of the

17-nation block rose 1.6 percent since the previous quarter, and

4.0 percent year-on-year.

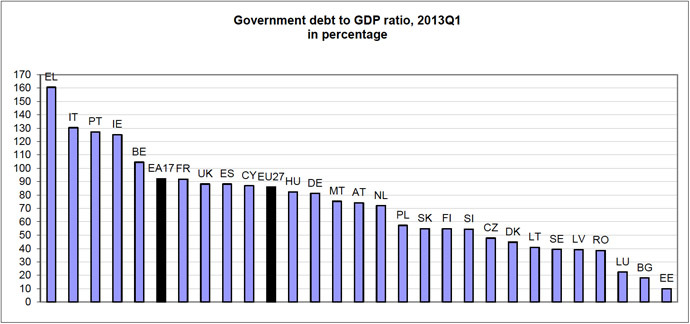

Hit hard by an 18-month recession, a continent-wide banking crisis, and sluggish trade demand, 5 countries in the eurozone have debt over 100 percent of their GDP.

Greece has 160.5 percent debt, and Italy, the block’s fourth largest economy, is burdened by 130.3 percent in debt. Portugal has 127.2 percent and Belgium’s debt climbed to 104.5 percent of GDP.

‘Bail-out’ states, those which have, or are currently receiving financial aid from the European Commission and International Monetary Fund to rebuild their economies, have some of the highest debt.

Greece, the first country to enter crisis and seek an EU bail out

in 2009, has a debt of 160.5 percent of GDP, the highest in the

EU, a 24 percent increase over the last year.

Cyprus, the most recent euro zone member to receive EU aid, has

government debt 86.9 percent relative to GDP.

Debt in Ireland is 125.1 percent of GDP, a 18.3 percent jump year-on-year. Ireland has officially re-entered recession as economic growth shrank for a third consecutive quarter, as the country continues to be weighed down by their 64 billion euro bailout cost.

Germany, the EU’s largest economy, and Estonia, one of the smallest, were the only two countries who managed to reduce their debt. Germany managed to trim debt to 81.2 percent relative to GDP, and Estonia has the lowest debt in the eurozone- 10.0 percent.

Low debt ratio’s were also recorded in Bulgaria (18.0 percent)

and Luxembourg (22.4 percent).

Austria and Germany were the only economies that didn’t shrink in

the first quarter. Europe’s second largest economy, France,

contracted by 0.2 percent.

Germany’s Bundesbank forecasts the leading EU economy will show robust Q2 growth, according to a monthly report released on Monday.

Across the 27-country block, including non-euro currency states such as Britain and Poland, the collective debt stood at 85.9 percent relative to GDP, at 11.11 trillion euros, up from 10.67 in 2012.

Collectively, EU leaders decided to tighten the grips on austerity to keep economic growth under control, but the kickback has been painful- most euro countries have remained, or re-entered recession.