Gold bounces back – but for good?

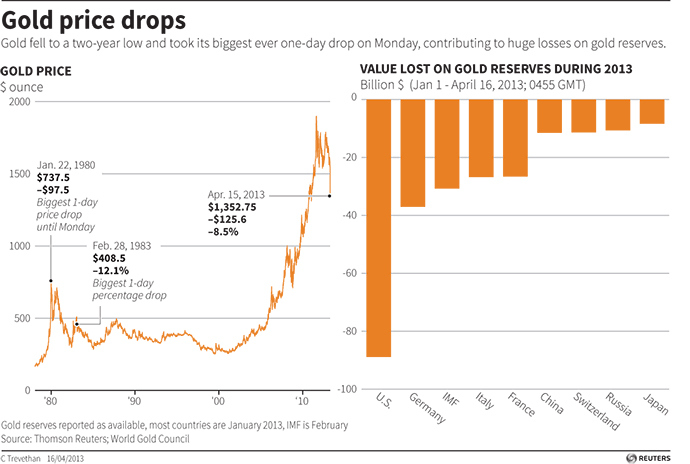

Gold is on the rebound after a 4.5% drop this week, and the plunge has triggered serious concern about the condition of the global economy.

The Comex index has passed the $1,400 mark, gaining 21.5 points to $1,412.60 an ounce at 15:17 DST.

“We are already seeing a strong response to the fall in prices, with a sharp pick-up in physical gold sales by investors and retail consumers in the two key consumer markets - India and China,” Mark Pervan, head of commodity strategy at Australia & New Zealand Banking Group, wrote to Bloomberg today.

While the value of the biggest gold producers declined by $169 billion, jewelers took advantage of the 30-year record-low gold prices to stock up for anticipated high demand retail and jewelry sales.

Chinese and Indian jewelers are optimistic that gold will

rebound as much as 29% by December 2013, to as high as $1,800 an

ounce, as demand increases, according to billionaire Indian jeweler

T.S Kalyanaraman, Reuters reported.

“There’s been continued buying interest, particularly into China,” Nigel Moffatt, treasurer of Australia’s Perth Mint said on Bloomberg Television Friday.

Americans took advantage of the price dip to buy stock in a historically high yielding investment.

In April, the US Mint sold 153,000 ounces of American Eagle gold

coins, a three year high, according to its website.

Red flag for continued recession

The recent slump in gold has been paired with disturbing economic data forecasting significant slowing in some of the world’s largest economies – the US, China, and Russia.

The gold drops are "signaling concerns about global growth," said Mohamed El-Erian, the co-chief investment officer of PIMCO, which oversees $2 trillion in assets, Reuters reported.

"Commodities have been sending the signal on growth for a while, and now even louder," El-Erian added.

Gold has certainly been the ‘loudest’ of the flailing indexes, after it plunged 14% in the first two April sessions, hitting a 30-year low as slowed growth data from the US and China trickled in. Prices also dropped as the Cypriot bailout payment plan toyed with the idea of selling 75% of their reserves to help finance the bailout, which spooked investors other cash-strapped European states, like Spain and Portugal, might do the same.

The economic slowdown was confirmed by the International Monetary Fund on Tuesday when it trimmed back its forecast on economic growth in 2013, down to 3.3% from the earlier 3.5% projection.

Citigroup predicted, and was correct, that 2013 would be the first year when commodity prices at the end of the year were lower than at the beginning.

Citigroup predicted the end of the ‘super-cycle’ – when rising prices commodities supersede demand.

As growth slows, governments are scrambling to find a way to stay afloat. Most governments are doing this via cash stimulus- simply printing more money to avoid deflation, the Bank of Japan the premier example.

The recent retreats in gold, oil, and other precious metals and energy stocks, are evidence to many of a weak - and maybe slightly unstable - economy. Because metals and energy are so closely tied to industrial growth, a decline in their demand can provide an accurate reading of an global economic performance.

The investors who saw it coming

As inflation falls, this in turn reduces the value of gold as a fortification against rising prices. If investors forecast an inflation dip, gold will also lose its value.

"Because the global economy is on the downside of a global credit bubble, it seems unreasonable to expect abnormal inflation," said Richard Bernstein, the head of an investment advisory firm in New York, Reuters reported.

Gold, a major investment for both individuals and institutions, provides a viable alternative to currency that their government can just print more of. It also provides and investment alternative to stocks.

George Soros cut his holdings in SPDR Gold Trust by 55% last quarter. He predicted the prices would tumble, and wasn't sure how quickly they’d recover.

Is it safe to follow the yellow brick road?

The title of JPMogran’s gold futures report is ‘The slide in global inflation may not be over.’

Morgan Stanley has cut its 2013 gold forecast by 16%, down to $1,487, as investors continue their selling frenzy.

The sell-off “has all the hallmarks of panic-driven, stale long liquidation, stop-loss and capitulation selling in the face of a concerted short sale” Peter Richardson, a Morgan Stanley analyst, wrote in a report.

According to JPMorgan’s report, it’s not a time to invest, or reinvest in gold.

Merrill Lynch recently warned that gold could fall to $1,200 before stabilizing, citing "fears of disinflation combined with news of potential central bank gold selling,” in their Tuesday report.

"Even at these levels, gold is still not attractive. The odds favor the bull market being over," said Jim McDonald, chief investment strategist at Chicago-based Northern Trust Global Investments, which in early March told clients to stop allocating a position to gold, Reuters reported.