IMF recognizes 'notable failures' in Greek bailout

The International Monetary Fund (IMF) acknowledged that it made ‘notable failures’ in its handling of the Greek bailout, admitting they had underestimated how deeply austerity measures would stint growth.

The IMF was successful in keeping Greece in the eurozone, which prevented the entire collapse of the currency bloc, and have helped keep the Greek economy afloat by pumping in over 200 billion euros ($258.8 billion).

Unemployment in Greece

-In 2012, Greek unemployment was 25%, which was 10% higher than the IMF’s projection of 15%, and it reached 27% in 2013.

-Greek unemployment is twice as high as the eurozone average, and a almost 65% of young people are of a job.

-The UN labor office predicts a global rise in unemployment of 12.8% by 2018.

With Greece in its sixth year of recession, and with an unemployment rate of 27 percent, in a rare moment of critical self-reflection, the IMF, has issued a report asking many ‘what if’ scenarios, retracing their steps in the 2010 Greek bailout, citing 'notable failures'.

In the titled ‘Ex-post evaluation’ report released on Wednesday, the IMF takes a slice of the blame in Greece’s worsening financial condition, as they grossly underestimated the impact of austerity measures on its economy.

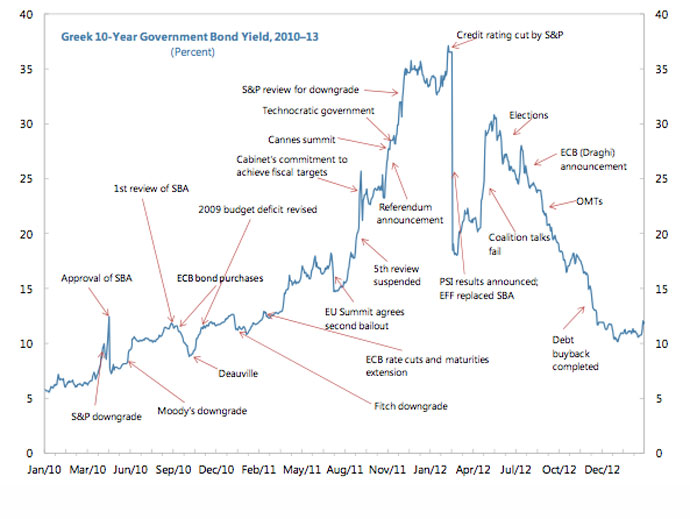

‘Notable failures’, according to the report, include failure in restoring market confidence, the banks’ 30 percent loss in deposits, high unemployment, waiting too long to restructure the nation’s debt, and a deepening of the recession. In short, under IMF policies, Greece’s recession worsened.

The EU Commission was quick to disagree with the report's key

findings, and EU spokesman Simon O'Connor said the critical

report was 'plainly wrong and unfounded' in a statement on

Thursday.

The IMF have four main criteria for qualifying bailouts, but Greece only fulfilled one out of the four.

The report analyzes whether or not granting Greece ‘exceptional access’ is justified now the country is in a much more severe recession than the ‘troika’ lenders forecast 3 years ago.

In exchange for economic aid, Greece pledged to massively reduce their government spending and to reform their economy under IMF supervision.

Cyprus, Greece, Portugal, and Ireland have all received bail-out

support from IMF lending.

Cyprus has been hit hard with its bailout arrangement, and is now urging its President to ask the European Commission that Cyprus be listed as a ‘poorer’ region of the EU, so they can be eligible for more structural funds. Currently, they are classified as a ‘rich’ country, based on their economic condition in 2004 when they entered the EU.

Blockupy

Activists met in Frankfurt on May 31st and staged a protest against European leaders' handling of the three-year euro debt crisis.

They blocked the entrance to the European Central Bank, one of the IMF’s ‘troika’ lending partners which gave Greece bailout funds.

Blockupy activists lay blame for the debt crisis in Europe with the banks and in particular the ECB for its role in imposing austerity measures on EU citizens.

Many activists expressed distrust in the IMF, only seeing it as a power-wielding organization that collects on European debt to influence its policy.

According to Blockupy, the austerity measures proposed by the so-called troika, consisting of the ECB, International Monetary Fund (IMF) and the European Commission have not reduced the national debt of the European countries. An increase in taxes and cuts to social programs have actually worsened the situation, deepening recession and increasing unemployment in the EU dramatically.