Ukraine gets $8bn investment from China

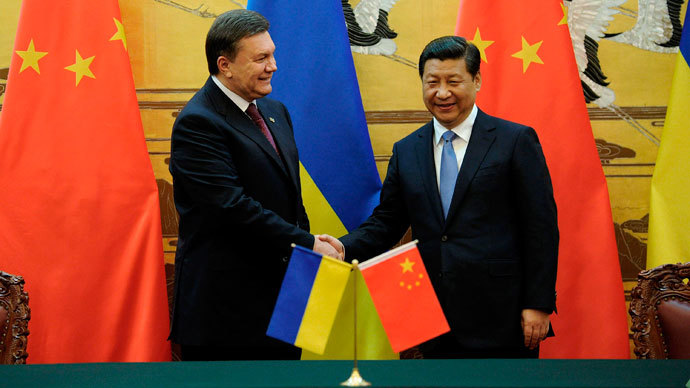

Ukrainian President Yanukovych left Kiev in search of foreign cash for his country's near bankrupt economy, and now he says he's secured $8 billion in investment from China.

The money has made a timely arrival in cash-strapped Ukraine’s hands, as the economy teeters on default and faces debts over $15 billion. Yanukovych is on a three-day planned working trip to China.

"The documents signed today expand our economic cooperation. We have not yet calculated how much this will make up in terms of money, but we made some calculations earlier and saw that the matter is about some $8 billion in investments coming to the Ukrainian economy," Yanukovych said after signing a number of bilateral documents in Beijing on Thursday, quoted by Interfax.

More investment documents are in their final stages of preparation, and are expected to be signed soon, he said.

China has already given Ukraine $10 billion in loans, Reuters reported, citing Volodymyr Fesenko of Ukraine’s Penta think-tank.

While Yanukovych signed papers in Beijing, a Ukrainian delegation

met with Russian government officials in Moscow, including Prime

Minister Medvedev to discuss trade issues such as customs

clearance, Ukrainian chocolate, meat and dairy products,

railways.

Protests broke out in Kiev over Yanukovych’s last minute rejection of an EU trade deal in favor of restoring economic talks with Russia, Ukraine’s top trading partner and energy supplier.

Ukraine hasn’t made a decisive step East or West, and for now seems to be shopping around for the best economic deal to bring calm to markets, bond prices, and opposition movements, before committing to either the EU or Russia.

Deep in debt

The government faces $15.3 billion in maturing loans that will further deplete the Central Bank's currency reserves. As of October 31, Ukraine’s international reserves dropped to $20.6 billion, according to Bloomberg data. The Central Bank intervening to repay debts will threaten the financial stability and the value of the hryvnia, Ukraine’s currency.

Public debt is just a piece of the debt abyss. State-owned companies are also at high-risk of bankruptcy.

Naftogaz, the state-run oil and gas company, has a 15 percent chance of default in the next 12 months, according to Okan Akin, a strategist at asset management group AllianceBernstein, Reuters reports.

The local currency, the hryvnia, is depreciating so fast investors worry a money lock down similar to Cyprus could take place. Authorities would use capital controls to protect the currency, limiting movement across borders.

Although Russia has repeatedly warned Kiev it will end trade benefits if it signs an association deal with the EU, Ukraine remains caught between Russia and the EU. Ukraine will send delegations to both the EU and Moscow “to restore economic trade relations,” Prime Minister Azarov said Tuesday.

Ukraine still owes state-owned Gazprom $2 billion in unpaid bills, and there is no plan to settle the debt, Gazprom head Aleksey Miller said Wednesday. His comment contradicts Tuesday’s statement by the head of Naftogaz that Gazprom has extended payment until the spring.

Gazprom, Russia’s largest natural gas company, ships half of its European gas through Ukraine.

After the collapse of the Soviet Union, Ukraine became a natural hub for transporting Russian gas to European and Turkish markets, but Gazprom is building a maze of new pipelines to circumvent their western neighbor in transit logistics.

Next stop: Russia

The next destination for President Viktor Yanukovych will be the country’s closest ally, Russia, where the countries hope to normalize “the roadmap of cooperation, which will imply normal trade and economic regime," Prime Minister Nikolay Azarov said.

Russia is Ukraine’s main source of energy, loans and trade, with Russia importing nearly 25 percent of Ukraine’s export goods.

Ukraine still owes state-owned Gazprom $2 billion in unpaid bills, and there is no plan to settle the debt, Gazprom head Aleksey Miller said Wednesday. His comment contradicts Tuesday’s statement by Naftogaz head that said Gazprom has extended payment time until spring.

Gazprom, Russia’s largest natural gas company, ships half of its European gas through Ukraine.

After the collapse of the Soviet Union, Ukraine became a natural hub for transporting Russian gas to European and Turkish markets, but Gazprom, Russia’s state-owned gas giant, is building a maze of new pipelines to circumvent their western neighbor in transit logistics.