'Manufactured' crisis cost US $24bn -S&P

Standard & Poor's says the shutdown in total cost the US economy $24 billion, or $1.5 billion per day, the rating agency said Wednesday. The agency also estimated the shutdown will pare fourth quarter GDP by 0.6 percent.

Follow RT's LIVE UPDATES on the US budget crisis

Obama has signed legislation that will avoid a technical debt

default, ending the 16-day partial shutdown of the government

that has cost the world's largest economy billions of

dollars.

"The bottom line is the government shutdown has hurt the US

economy," the S&P statement said.

Moody’s Analytics has estimated the government shutdown could cost the US government up to $55 billion, the same amount as devastating Hurricane Katrina in 2005.

The deal will reopen the government after 16 days of partial shutdown and fund spending through January 15 while extending the $16.7 trillion debt ceiling through February 7. This time frame would be longer than the 6-week extension Obama promised to veto.

The next major deadline is the December 13 - target date for a budget negotiation.

US Speaker Boehner did not block a vote on the legislation

in the House, as the lower chamber passed the bill 285-144,

putting an end to the weeks-long stalemate.

The Senate passed the plan earlier Wednesday by a vote of 81-18.

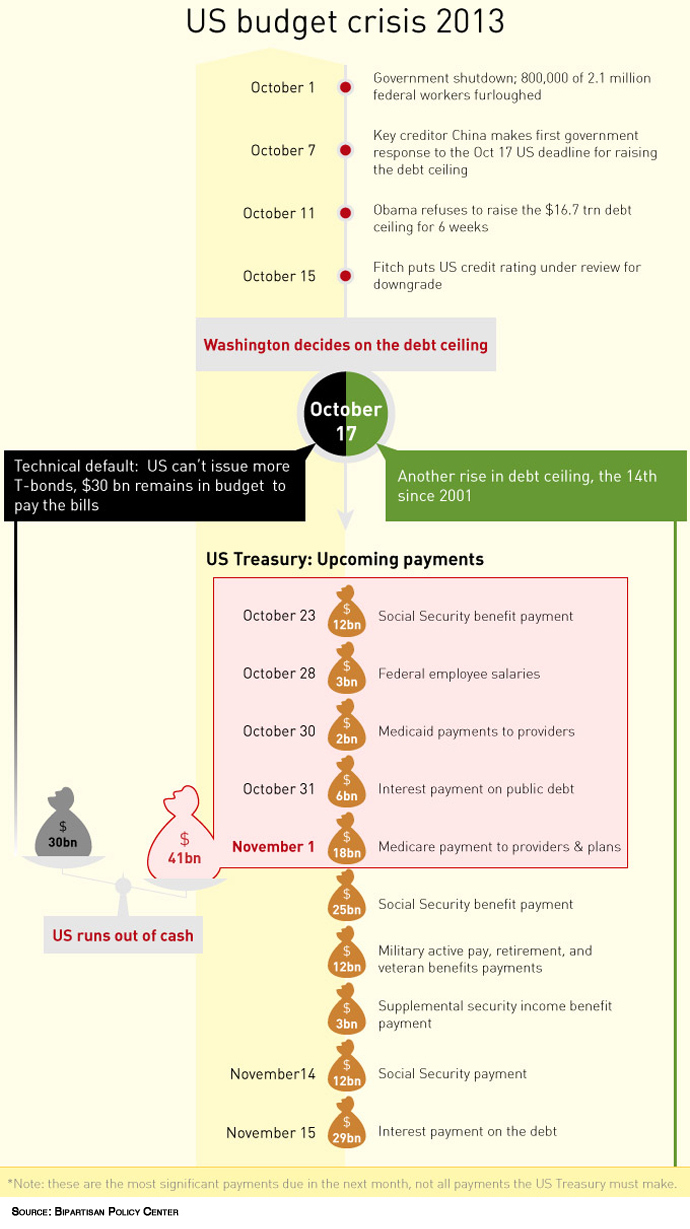

If the ceiling wasn’t lifted by October 17, the world’s biggest

economy would not have had enough cash on hand to pay its bills.

Previously, IHS Global Insight, a Massachusetts-based research

firm, estimated the shutdown was costing America $1.7 billion per

week in lost economic output according to a study.

Shutdown.com, whose data models and averages the IHS

estimate, marks the cost of the government shutdown at $4.7

billion.

The financial burden of the shutdown has already surpassed the at

least $2 billion in destruction brought by floods and mudslides

in Colorado in September, according to Eqecat Inc., a

California-based catastrophe-risk consultant.

Damage is done

In place for almost a century, first introduced in 1917, the US has never defaulted on their debt. Republicans and Democrats have used the debt ceiling as a political gambit to rehash budget wars, and every time, put investors on nerve and world markets on edge. These political games have damaged the US' reputation, and could have a lasting effect.

State-owned Chinese media lambasted the US for creating

“manufactured crises”. China, which holds the lion's share of US

foreign debt in dollar reserves, nearly $1.3 trillion, would have

a lot to lose if it wakes up on October 18 and the US dollar has

tanked and Treasury bonds and yields fall.

Fitch Ratings agency announced on Tuesday it has put the United States’

‘AAA’ credit rating on review because of the stalled debt ceiling

negotiations.

The ‘political brinkmanship’ and ‘reduced financial flexibility’

of the US were cited as reasons to consider downgrading the

superpower. The 26 day shutdown in 1995-1996 cost the US economy

over $2.1 billion in current dollars, according to the Office of

Management and Budget Data.

However, the far-reach of the American economy and the dollar as

a reserve currency may preserve the US’s dominant role in the

world economy.

“While the US economy still growing and remains the most

efficient in the world, it cannot worry too much about their

image,” Igor Nikolaev, director of the strategic analysis

department at PKF told RT.

US gross domestic product is still projected to grow 2 percent in

the fourth quarter, but some economists worry the dollar, already

at an 8-month low, is at more of a risk because of the default,

and the more politicians play with fire and brinkmanship the

markets will flinch.

Last time Congress debated the debt ceiling in 2011, Standard

& Poor dropped the United State’s ratings from AAA to AA+.

The first shutdown in 17 years hit America at a vulnerable time,

as it is still digging its heels out of recession and starting to

recuperate from the 2008 financial crisis, which stemmed from

America’s ‘too big to fail’ banking industry.