UK banks ‘have much to fear’: competition watchdog set to probe Lloyds, RBS, HSBC and Barclays

Barclays, RBS, HSBC and Lloyds may be forced to break up following a finance watchdog’s inquiry. The watchdog claims Britain's banking sector is characterized by anti-competitiveness and a failure to meet ordinary citizens and small business' needs.

Outlining its proposals for a sweeping 18-month investigation into Britain’s major banks, the newly-established Competition and Markets Authority (CMA) has eclipsed its predecessors who were unwilling to launch an inquiry of this nature until 2015.

Britain’s ‘big four’ - Lloyds Banking Group, Royal Bank of Scotland (RBS), HSBC and Barclays – dominate the UK's £10bn-per-annum banking sector. All four banks have been engulfed by scandal in recent years, yet they collectively control 77 percent of UK citizen’s current accounts, 85 percent of UK small business’ current accounts, and an overwhelming 90 percent of UK business loans.

Two CMA studies, published on Friday, concluded core elements of the UK’s retail banking sector lack “effective competition” and ultimately fail to meet the needs of personal consumers or small to medium-sized enterprises (SMEs).

The CMA’s research revealed that while public satisfaction with these dominant banks falls shy of 60 percent, their market shares have remained steadfast. The studies concluded smaller banks with higher satisfaction ratings were simply unable to compete or acquire a sizeable share of the market.

“Competitive personal and SME banking markets are essential to households and businesses throughout the country, and to the success of the UK economy. However, our studies have found that despite some positive developments, significant competition concerns remain which mean that customers may not be getting consistently good service and value from their banks,” Alex Chisholm, CMA’s chief executive, said.

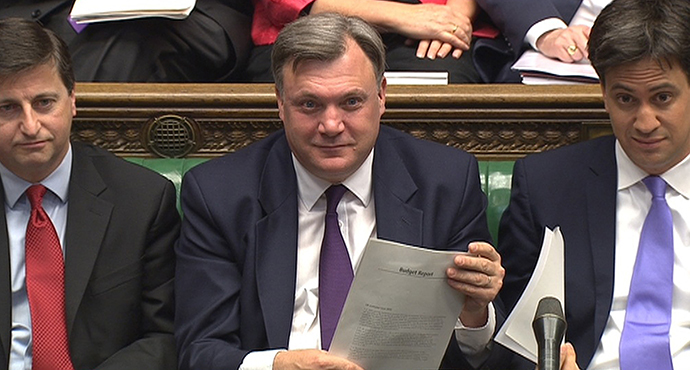

The CMA’s plans to launch the inquiry have emerged at a time when scrutiny of the UK’s banking sector is gathering momentum in Britain’s political ranks. Labour leader Ed Miliband, has vowed to back a competition investigation if elected in next May’s general election. And Shadow Chancellor Ed Balls emphasized the need for widespread reform on Friday.

"As we said earlier this year, in the next parliament we need to see at least two new challenger banks and a market-share test to ensure the market stays competitive for the long term," Balls said.

National Chairman of the Federation of Small Businesses John Allan cautions against an effective monopoly held by Britain’s biggest banks, outlining its detrimental effect on small businesses.

"Since Cruickshank's report, a few very large banks have dominated the market for small business accounts, which suggests that competition has remained limited. In addition, there continue to be a range of barriers to entry that either potentially deter entry to the market or block new entrants' growth.This means small firms have not seen the full benefits of reduced costs, increased choice and better access to finance had these structural issues not been in place,” he said.

The British Bankers' Association (BBA) argues there are currently substantial changes underway in Britain's banking sector. The association recently published an array of proposals it claims would encourage and facilitate the growth of new and emerging UK banks. The BBA hoped regulators and politicians would be amenable to its suggestions. But the CMA have elected to pursue a full-scale inquiry.

In theory, such an inquiry could order a full-scale break up of Britain’s largest banks. But such comprehensive reform is rare. Following the inquiry, the CMA will most likely demand banks cultivate new networks of branches and adopt greater levels of transparency with respect to their charges.

Ethical banking campaign group Move Your Money (MYM) welcome the CMA’s planned probe.

"We've been saying this for years. People want real alternatives. This is something the big banks would have you believe don't exist, but they do”, Charlotte Webster, campaign manager for the group said on Friday.

Millions have switched banks in the last year, but a concrete shift from a monopolized banking sector to one characterized by diversity and ethics is yet to be realized. Reflecting on whether this CMA investigation will reap positive change, Joel Benjamin - a leading researcher at MYM - told RT on Friday:

"The CMA is a new regulator being reformed from the OFT so the jury is out in terms of the CMA's effectiveness. We know Britain's largest banks have substantial lobbying power, and will spend the next 18 months trying to water down this inquiry and any subsequent recommendations. At MYM we consider financial reform too important to be left in the hands of politicians, and believe real change will come when people are empowered to move their money - voting with their feet to demand a financial system that serves people and the planet."

"Recent promises to reform bank culture and stop the fraud and mis-selling from the likes of Barclays' Antony Jenkins have largely gone unfulfilled, and politicians and the public have lost patience", he concluded.

The CMA's investigation is the 10th analysis of the market since Don Cruickshank was commissioned to examine the industry by then-Prime Minister Gordon Brown in 1999. Former investment banking correspondent at the Financial Times, Chris Hughes, suggests UK banks “have much to fear” from the probe. But the efficacy, comprehensiveness and independence of this planned inquiry remains to be seen.