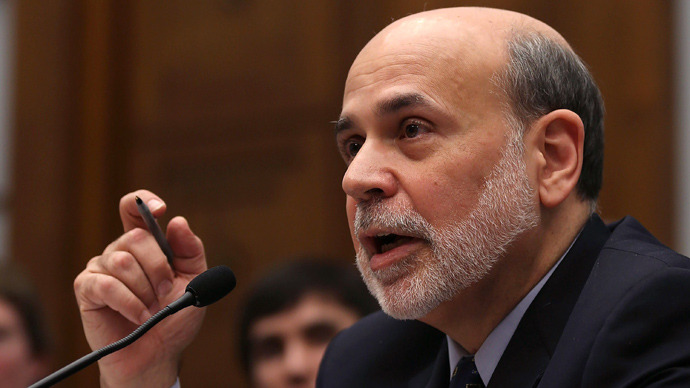

Bernanke’s legacy: Fed set to lose $500 billion

Economists predict that the US Federal Reserve could lose half a trillion dollars in just three years thanks to policies enacted by the central bank under Chairman Ben Bernanke.

A study conducted by investment analysts at New York City’s MSCI Inc. suggests that Mr. Bernanke’s efforts to keep the floundering economy in tact on the heels of a recession have proven to be futile and will continue to collapse.

According to Bloomberg News, who contracted MSCI to conduct the study, the potential losses the Fed could see during the next three years are “unprecedented.” MSCI says the market values of Fed holdings are likely to shrink by $547 billion during that span.

The group says they concluded as much after using stress-test scenarios designed by the central bank to examine how the value of securities held in the Fed’s portfolio at the end of 2012 will stand up during the next few years. In a situation involving economic contraction and rising inflation, MSCI expects the Fed’s holdings to drop drastically by more than half of a trillion dollars.

Should conditions improve, however, losses may not amount to that substantial of a figure. If the economy performs “in line with consensus forecasts of gradually rising growth, inflation and interest rates,” reports Bloomberg, the mark-to-market loss during the next few years could amount to ‘only’ $216 billion. Sarah Binder, a senior fellow at the Brookings Institution, tells Bloomberg that either way she expects a hostile response from Washington.

“Even if there’s a perfectly logical explanation and the normalization of the balance sheet is a good thing in the long term, the headlines will probably generate congressional scrutiny,” she says. “That’s never a good thing from the Fed’s perspective.”

So far, though, the central bank has stayed optimistic. Speaking in Washington on Tuesday, Bernanke told the Senate Banking Committee that the Fed “remains confident that it has the tools necessary to tighten monetary policy when the time comes to do so.” At least one lawmaker, though — Sen. Bob Corker (R-Tennessee) — is skeptical. Hours after Bernanke’s address, he sent a letter to the chairman asking, “Do we have a serious policy problem brewing here, or is this simply an optics problem about which we should not be concerned?”

Others have reacted positively to Bernanke’s remarks and have said his confidence could be a good think. His comments did not affect the price of oil on Wednesday morning, and the Sucden Financial Research said that the chairman’s statement may have had something to do with keeping the cost of crude from rising.

"It seems that the optimistic comments from Bernanke overshadowed the political uncertainty of the Eurozone and raised hopes about a possible rebound in the oil demand for the rest of 2013,” the report reads.

Whether Bernanke’s predictions prove to be correct is another story, though. According to the MSCI report, the chairman’s policies are on track to cause the Fed to lose a substantial loss in a short amount of time. Bernanke says his policy of “credit easing,” or buying back debt from the Treasury and federal housing agencies, as well as mortgage-backed securities, is key to improving the economy. As interest rates ride, however, returns from the Fed’s holdings are sharply shrinking.

“The political backlash could be particularly acute given that a good portion of the funds that would otherwise be remitted to the Treasury would be transferred to large financial institutions in the form of interest paid on reserves,” Laurence Meyer, a former Fed governor and co-founder of Macroeconomic Advisers LLC in St. Louis, adds to Bloomberg. “This could present a significant communication challenge for the Fed and adversely impact its reputation.”

Bernanke’s second four-year term as Federal Reserve chairman expires next year and he has not announced his plans for the future. Speaking to the Senate, however, Bernanke did say that he thinks the Fed should continue with its current policies, regardless of how some economists think it will work.

“To this point we do not see the potential costs of the increased risk-taking in some financial markets as outweighing the benefits of promoting a stronger economic recovery and more rapid job creation,” Bernanke said.

Should the “unprecedented losses” predicted by MSCI occur, though, the bank might start to see those risks. The New York Times reports that losses in the hundreds of billions could mean the Fed would be unable to move profits to the US Treasury Department for the first time since the 1930s.