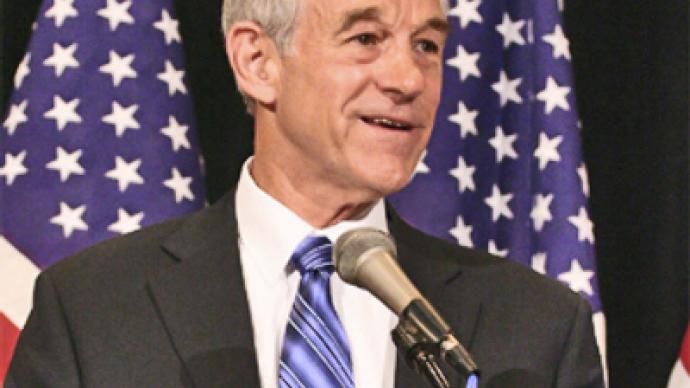

Ron Paul drums up congressional support to audit Federal Reserve

The Republican Ron Paul has enlisted 271 Congressman in his campaign to pull back the shroud of mystery surrounding the ultra-secretive US Federal Reserve, but even he admits there are many battles left to fight.

After a decades-long fight to conduct an audit of the US Federal Reserve, America’s privately controlled money mint that enjoys exceptional secrecy and independence, the feisty congressman from Texas is finally seeing a bit of sunshine through the cloud cover.

Paul’s legislative effort to crack open some of the secrets of the temple has won unanimous support from the 178 House Republicans, all of whom have signed on as cosponsors of the Federal Reserve Transparency Act, known as HR 1207.

“Now more than ever, we need to know what the Fed has been doing in secret,” Congressman Paul stated in a press release. “I am pleased that all of my Republican colleagues in the House, as well as many Democrats, understand the need for this kind of transparency.”

In addition to the 178 Republicans in support of the legislation, 97 House Democrats have thrown their support behind the initiative, thus marking one of those rare bipartisan moments in American politics. HR 1207 now has 271 cosponsors and has been sent to the House Financial Services Committee for further consideration.

Strange that such an incredible turn of events for the soft-speaking congressman from Texas, who was in the running to be a Republican presidential candidate in the latest elections, has barely registered a blip in the mainstream US media.

Will the Federal Reserve open its books?

Demands to restructure the financial regulatory system began in earnest with the near-collapse of the global financial system in the fall of 2008, which was triggered by supposedly sophisticated investment schemes, most notably the subprime mortgages.

The US Federal Reserve (an organization, it is important to remember, that is not an official branch of the US government, although the US president does have the authority to select the chairman) has come under unwanted scrutiny in the wake of the global economic crisis, which saw the Fed step in to rescue some of the biggest names in the banking industry.

On June 17, 2009, US President Barack Obama proposed a new regulatory device for the nation’s financial system. But instead of demanding more oversight of the Fed’s printing and loaning habits, which have been careless of late to say the least, Obama called for the “enhancement of the Federal Reserve’s regulatory powers.”

For members of Congress who want to see the Fed regulated, not turned into The Regulator, this was the last straw. Now, Paul is enjoying a groundswell of support from once skeptical peers from both sides of the political fence.

In June, as Ron Paul’s push for more government oversight of the Federal Reserve was gaining momentum in Congress, Reuters presented him with the following question: “Chairman Bernanke has said that your bill could revoke the independence of the Fed. Is that your intention here?”

“Well, that wouldn’t be too bad of an idea,” Paul replied with a laugh. “Why should they be independent? Independent to them means secrecy; do whatever they want. Spend trillions of dollars, bail out their friends, and make deals with international bankers, with other central banks and governments… They shouldn’t have a right to do that. We have an obligation, as members of Congress, to protect the people, and protect the value of their money.”

When told that the Federal Reserve might want to raise interest rates when it’s “politically unpopular,” Paul explained that the opposite could occur as well, equally for political reasons. He also strongly hinted that the Fed could affect the outcome of a presidential election by agreeing to play with interest rates.

“Well, they might also want to lower interest rates when it’s very popular for political reasons,” Paul explained with his usual candor. “This idea of independence is a façade because others have done some investigation and traced the willingness of the Federal Reserve Board Chairman to talk to and work with the presidents, you know, when they want reappointed. So there’s a lot of political shenanigans going on with the Fed.”

Paul stressed that the Fed should not fear his bill because it does not tell it what to do. Rather, it simply wants to know what the Fed is doing.

“We have an obligation to know what they’re doing, what kind of money they’re spending, and who’s getting the benefit.” (For a shockingly revealing congressional question-and-answer session between a Florida congressman and the Inspector General of the Federal Reserve, click here to watch video)

Ben Bernanke, the chairman of the Federal Reserve, has been fielding tough questions from lawmakers the past week about the inside operations of America's most secretive organization. He has even been doing a bit of a speaking tour in his effort to explain the Fed’s decision to intervene on the behalf of huge companies that were “too big to fail.” He even expressed his fears about going down in history as the Fed chairman who “presided over the Second Depression.”

“I was not going to be the Federal Reserve chairman who presided over the Second Depression,” Bernanke told a town-hall-style meeting at the Federal Reserve Bank of Kansas City. “The Federal Reserve has been putting the pedal to the metal, and we hope that’s going to get us going next year sometime.”

It seems a bit strange that Bernanke, whose personal assets plunged 29% during the crisis, seems more concerned about what the historians will think about him, as opposed to the potential long-term damage caused to the American (and global) economy by rushing to save failed banks, as well as pumping trillions into the system (and as the linked video above shows, with little or no oversight).

Ironically, the Federal Reserve was adamant about “transparency” when it was buying up failed assets at the end of last year, but now it sees no reason why it should open its own books to the auditors.

“I don’t think it’s (Paul's plan to audit the Fed) consistent with independence,” Bernanke said of the Paul’s plan to subject the Fed to the Government Accountability Office (GAO). “I don’t think people want Congress making monetary policy.”

But would it hurt to have a peek at the Fed balance books just once a year? It seems that any democracy would demand as much.